A Negative FED: The Domino of the TradFi Crisis

Find out about the ideal bridge that could hold the key to a new financial future

With the central pillar of TradFi now operating at a financial loss, there are significant implications on what the future holds for the entire realm of finance. Yet there are likely several semi-interdependent paths, which could occur and we will logically dissect the strengths and weaknesses, of these various outcomes.

For reference, we'll build off of some information discussed in Lyn Alden's recent piece on "How the Fed Went Broke".

At one end of the spectrum, there would be a continual juggling of balance sheets to keep up the FEDs (US Federal Reserve) global facade, and therefore its relevance. While another polar opposite solution would have an entirely decentralized financial structure (DeFi) overtake the legacy system, and thereby onboard billions of people from fiat in the process.

However as highlighted in “The Low Down on Interest Rates and Financial Pyramids”, there are still numerous ongoing and overlapping layers to be accounted for, within the financial space at large. Although it is unlikely that DeFi would be able to effectively link up with all of those areas successfully, it is also arguably equally unlikely that the centuries-old centralized TradFi structures would be able to quickly incorporate the latest blockchain technologies. In all likelihood, what will need to happen to avoid an utter fiat collapse or a complex crypto crash, will be the emergence of the proper synergies that utilize the strengths of one system to compensate for the downfalls of the other.

The DeFi-TradFi Bridges

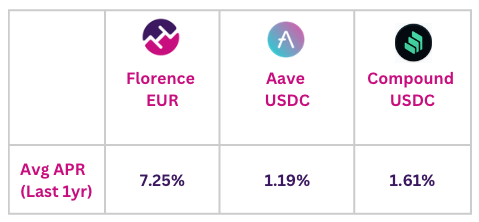

Fortunately of late, we are seeing crucial bridges being formed, such as having a percent of the treasuries from prominent stablecoin platforms being placed into interest-bearing government bonds. Of course, there is also the niche expertise of companies like Florence Finance, which concerns itself with the lending of Real World Assets (RWA). Without being biased, this could perhaps be one of the biggest catalysts, in terms of syncing elements of the TradFi realm into crypto and vice versa.

From a DeFi perspective, there has been a realization recently of the more favorable and predictable yields that are created by real-world businesses, compared with the opaqueness and highly speculative nature of locking funds up in smart contracts. At the same time, RWA also offers an ideal format for integrating into the TradFi system, since their underlying offer is one that commercial banks comprehend and perform themselves.

Downward Trajectory of the FED

First and foremost though, it would be wise for any of our financial anchors, to solve the fundamental issue of being solvent, which the FED is currently not. Anyone with a tad bit of business savvy would understand that in order for an entity to remain profitable, it’s necessary that their assets exceed their liabilities. Despite crafty accounting tactics, that reframe losses as ‘deferred assets’, the business of the FED is undoubtedly on a downward trajectory.

In short, its assets which are mainly treasuries and mortgage-backed securities, are earning less interest than what they are paying on its liabilities. The problem is further compounded, when one factors in the FED’s sudden and significant interest rate hikes, which are also deemed a necessary mechanism to curtail inflation. With a hint of irony and wackiness, the entities that are profiting the most off of the misfortunes of the FED, at least in the short term are the commercial banks.

This is due to the fact that commercial banks deposit their cash at the FED, and in turn, earn interest on it. Without a doubt, this is an unsustainable dynamic, but there’s an even worse reality that is starting to run its course on the everyday depositor and SME in TradFi. Mainly, borrowers are encountering increasingly tedious loan processes and high-interest rates, while depositors are earning little to no interest income.

Since this accessibility to capital and incentivization is now becoming rare, the average person or business would be better off seeking alternative options in DeFi.

Herein lies both the challenge and opportunity that DeFi will seemingly face in the 2020s. On one hand, by empowering users with a better service and overall product, commercial banks could face a palpable extinction. At face value, the speed and efficiency of blockchain along with the potential for higher interest yields should make DeFi the clear choice.

Yet the shortcomings of DeFi, for the legacy TradFi user, lie in its complexity. While the concept of decentralized finance is great, and understandable to many, the products themselves are what DeFi needs to refine as simply as possible. For starters, there are; yield aggregators, yield optimizers, vaults, staking, centralized exchanges, and a whole lot more. This whole range of options, their respective projects, blockchains, and wallets, is surely enough to make normal people long for their plain jane checking, savings, and credit accounts.

Transparency: The X-Factor

However, the humorous matter is that despite this familiarity over the years, people still do not have a clue about how the TradFi system actually works. Would it spark a fiery desire to change if people knew that they, and their deposits, were effectively the bank’s assets? That they, the people and their transaction therein, were the fundamental driving force behind the bank’s entire business?

The same idea also holds true about DeFi, in that it obviously needs people to make it work, in the form of providing liquidity, using products, and sharing sentiments within a community. What is completely different, or at least should be for DeFi to make meaningful inroads, is the aspect of transparency. It would be wise for DeFi, to not make the same mistakes as TradFi in receiving a deposit, and thereby sending it to interact with a myriad of smart contracts in order to gain a ‘yield’.

RWA: The Ideal Bridge

RWA and its lending and borrowing principles, present an ideal bridge between both the DeFi and TradFi spaces. Regardless of any macroeconomic implications, such as those discussed in this article, businesses and people will always be on the lookout for capital, or ways to earn interest on their money. It allows a nice cross-pollination to take place since it enables native DeFi users to gain exposure to assets in the real world while giving TradFi people terminology and simplicity that they understand.

At Florence Finance, we’re excited to be in the position to continue developing and enhancing the practical use cases for RWA, so that they can make the greatest impact on finance as a whole.