Real World Asset Lending: The Next Big Trend in Crypto?

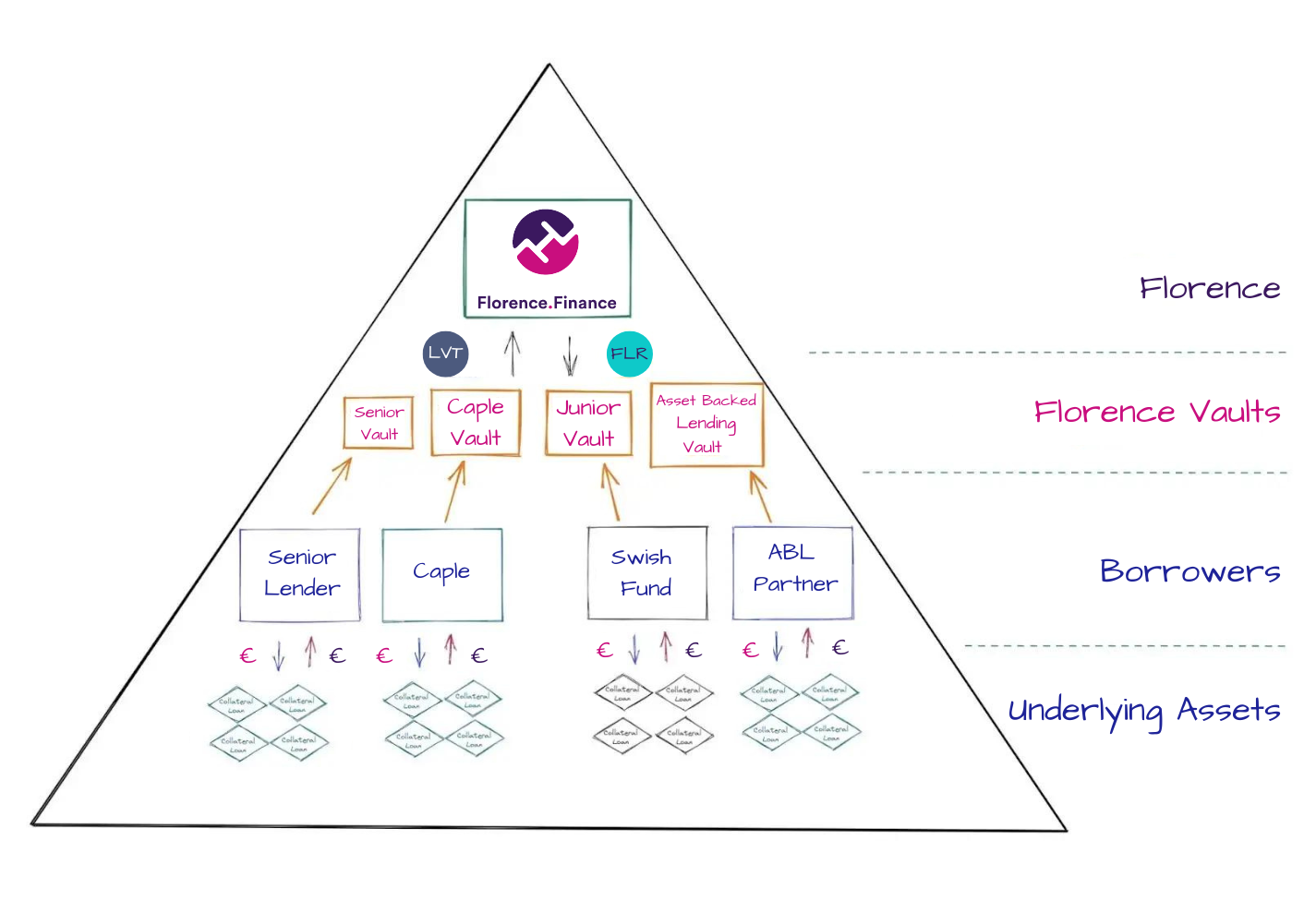

Find out how this $150 million investment in Real World Asset Lending is supporting our vision at Florence Finance

Our friends over at MakerDAO have put their money where their mouth is, and together with Centrifuge, have made one of the most significant on-chain investments ($150m) into real-world assets to date. Not only does this show how seriously they are taking their real world assets (RWA) initiative, but it also displays some vital insight as to where the market is headed. We at Florence tip our hat to both Maker & Centrifuge, as we too are of the view, that RWA is the next building block needed to drive mass adoption for DeFi.

In the beginning, we wanted to create a EURO equivalent of Maker. Though when we realized that it would be complicated both technically, as well as from a regulatory perspective in the EU, we set out to create the essential primitive in, which to issue EURO pegged tokens to use in DeFi.

From a subjective standpoint, we believe that our mission at Florence Finance is important for three reasons:

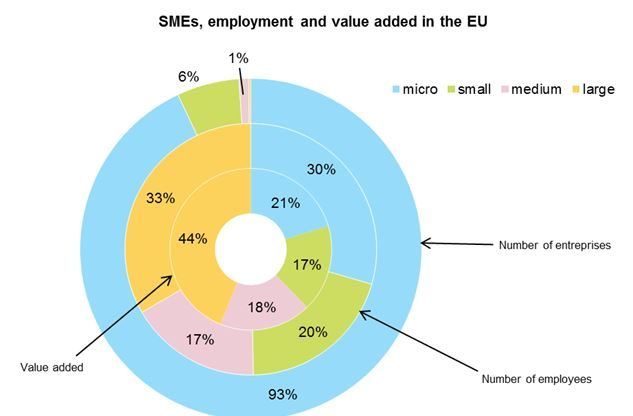

1) We are providing an alternative source of funding for Small and Medium Enterprises (SME), which are becoming increasingly neglected by banks in recent years.

As indicated by the above graph, the total addressable market (TAM) of SME lending in Europe is extremely large and ripe for innovation. In fact, a 2021 report by the European Central Bank showcased that while loan demands stood at approximately €1400 billion, available loan supply was only €1000 billion, leaving a significant financing gap of €400 billion.

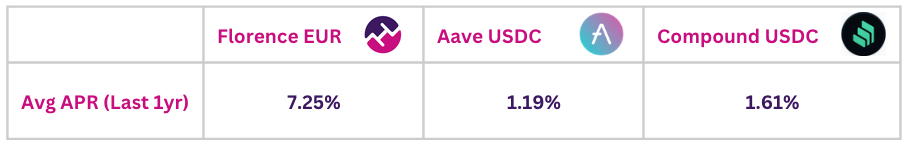

2) We want to create a safe haven for crypto investors, that are looking for real-world EURO-denominated yields.

The major stablecoin lending platforms in crypto such as Aave and Compound rely on crypto market sentiment for their yield. While these are undoubtedly great platforms and innovators in the space, our goal is to offer a more stable and lucrative yield, which does not need to rely solely on the crypto market.

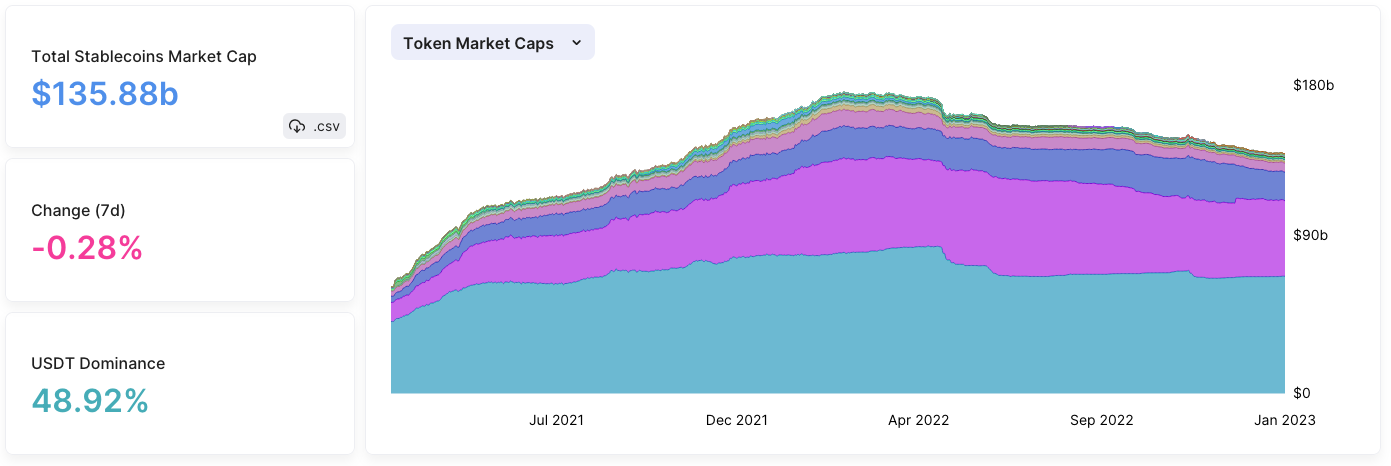

3) At the moment, the Euro DeFi space is still hugely under-serviced and we feel it's time to create the building blocks for composable asset-backed & yield accruing EURO-denominated tokens. Thanks to our friends at Defillama, we can see on the charts below the incredible size difference, between the USD and EURO stablecoin market. The USD stablecoin market cap is nearly 570x larger than that of the EURO, so there is still considerable room for growth.

Once at scale, our EURO denominated loan-asset backed tokens will become composable as an alternative to non-yielding stable coins, and also serve as a practical way to implement on-chain EURO denominated yield generation. As we continue to make our use case more and more viable, there are many areas in which it could be applied within the crypto space, including integrations into larger lending platforms such as Aave, Maker, and Compound.

Having launched our first lending pools with the help of funding partners 3CC and NewForm Capital, our next step is to open up participation to the public, through a third party liquidity pool on Curve (EURS/FLR).

The 3 Phases Of Stablecoins:

We have seen three phases in the evolution of stablecoins so far. Phase 1 is akin to a money market fund, which is your USDC + USDT stablecoins that earn interest with their reserves, but do not distribute this interest income to token holders. Phase 2 is the multi-collateral stablecoins such as DAI, that are backed by more volatile assets, while phase 3 deals with algorithmic stablecoins where the stablecoin is algorithmically pegged. As many of us know, phase 3 has seen some valiant efforts fail spectacularly so it is yet to be proven, and phase 1 has just been a license to print money for the issuers without adequately rewarding users.

With a quick bit of napkin math, we can estimate just how much Circle and Tether have been printing with their reserves. If we take the estimate, that their reserves of 66.4B USDT & 43.2B USDC are being deployed into short-term US government bonds that currently yield roughly 4% APR, then we can deduce that Circle and Tether are making $1.77B and $2.65B a year respectively.

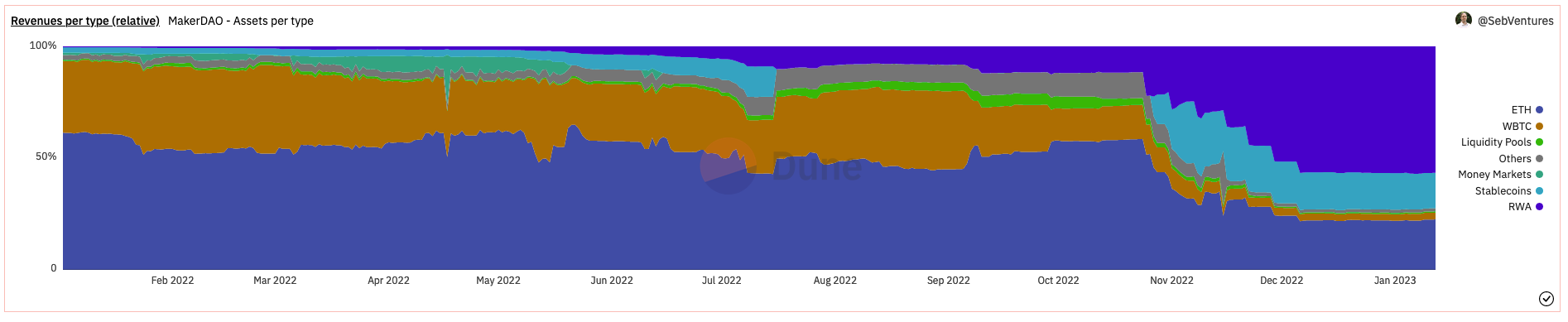

While the money market model has been extremely successful so far, we believe that a combination of regulatory and competitive pressures will eventually force one or more of the major stablecoins to share the underlying yield with their holders. The irony of course is that in this scenario, crypto ends up becoming little more than an alternative funding mechanism for government bonds, which in many ways runs against the spirit of DeFi. Yet, we understand that US government bonds are a logical place for Maker to start. By making transparent their RWA efforts, they are showcasing the benefits of what it can achieve, as the vast majority of MakerDAO revenue is now from RWA as seen in the chart below.

Why RWA Lending?

It is clear to us that in order to solve this conundrum, we need to connect DeFi to non-government issued RWA lending. This will allow us to generate non-speculative and inflationary real yield, while driving the use case for crypto into saving and preserving capital. In turn, this is likely to drive further adoption, while addressing and decentralizing real-world financing needs.

All in all, we are thrilled to see RWA lending as a growing theme. MakerDAO and Centrifuge are making big progress in the RWA lending market, by focusing on the registered end of the spectrum. At Florence Finance however, we want to go the extra step and pursue the unregistered sector. We want to address the part of the market that TradFi has given up on and neglected, in a way similar to how GoldFinch is approaching emerging markets and microlending.